FAQ RSS

This is my personal blog where I answer frequently asked questions about Hungary, emigrating to Hungary, buying a house in Hungary and living in Hungary. You can follow my blog using the RSS button if you have an RSS feed reader installed. There are various free readers you can easily install as a plug-in.

The Balaton price anomaly: 20 years of the Hungarian real estate market in fact check and why the lake is now beating Europe

Published on January 13, 2026

Keywords: buy house Balaton, Balaton real estate prices, price comparison Europe

The real estate market at the Balaton has transformed over the past two decades from a simple summer retreat for the domestic market into an international premium destination.

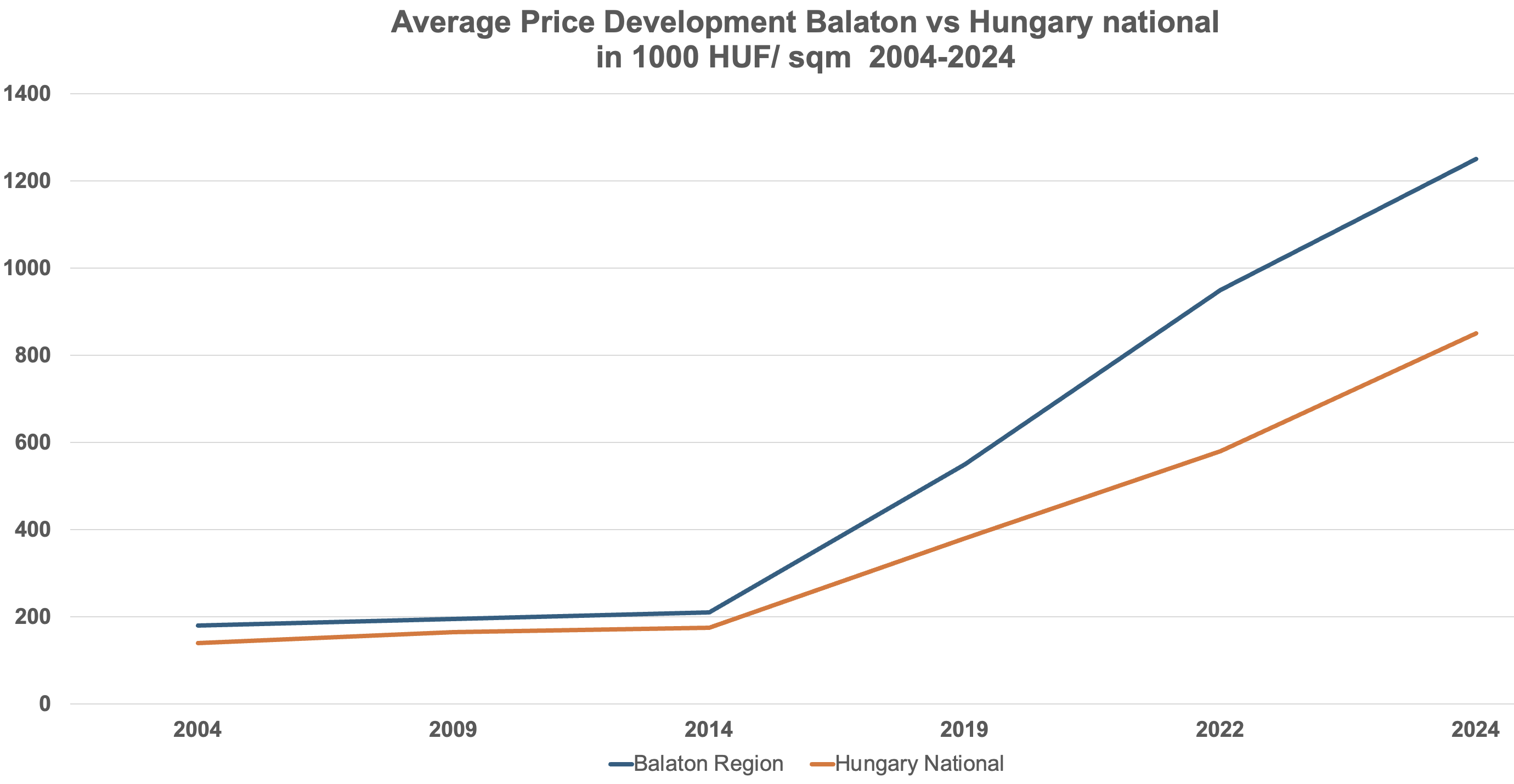

The data shows a decoupling from the Hungarian average: while national prices rose linearly, prices in the Balaton region developed exponentially, driven by tourism, infrastructure, and the “work-from-anywhere” trend.

Current analyses for 2024/2025 confirm that top locations at Lake Balaton are now more expensive than Budapest’s elite districts. For investors, there is still a massive arbitrage opportunity compared to Western European lakes.

The Status Quo: More Than Just the “Hungarian Sea”

Twenty years ago, a house at Lake Balaton was an emotional purchase, often a simple Kádár cube house or a wooden weekend cottage. Today, it is a hard asset class. The transformation since Hungary’s EU accession in 2004 is almost unparalleled in Europe. Anyone who wants to understand the market today must stop comparing it to 2004 and start comparing it to Lake Como or Lake Constance.

The decisive turning point was not EU accession, but the years 2014 (start of the boom) and 2020 (Covid pandemic), which turned Lake Balaton into a year‑round residential location.

Data Analysis: Price Development (2004–2024)

Based on aggregated data from the Hungarian Central Statistical Office (KSH) and analyses from broker networks, the following picture emerges for average square‑meter prices (existing properties):

| Year | Lake Balaton (Ø HUF/m²) |

Hungary (Ø HUF/m²) |

Drivers |

|---|---|---|---|

| 2004 | 180'000 | 140'000 | Hungary joins the EU |

| 2009 | 195'000 | 165'000 | Global financial crisis |

| 2014 | 210'000 | 175'000 | Market bottom, recovery |

| 2019 | 550'000 | 380'000 | Tourism, CSOK |

| 2022 | 950'000 | 580'000 | Inflation, home office |

| 2024 | 1'250'000* | 850'000 | Interest rates & quality |

*Value represents prime locations. Top-tier locations in Tihany or Balatonfüred are significantly higher.

If you display the development graphically, you can clearly see the increasingly divergent trends from 2014 onward.

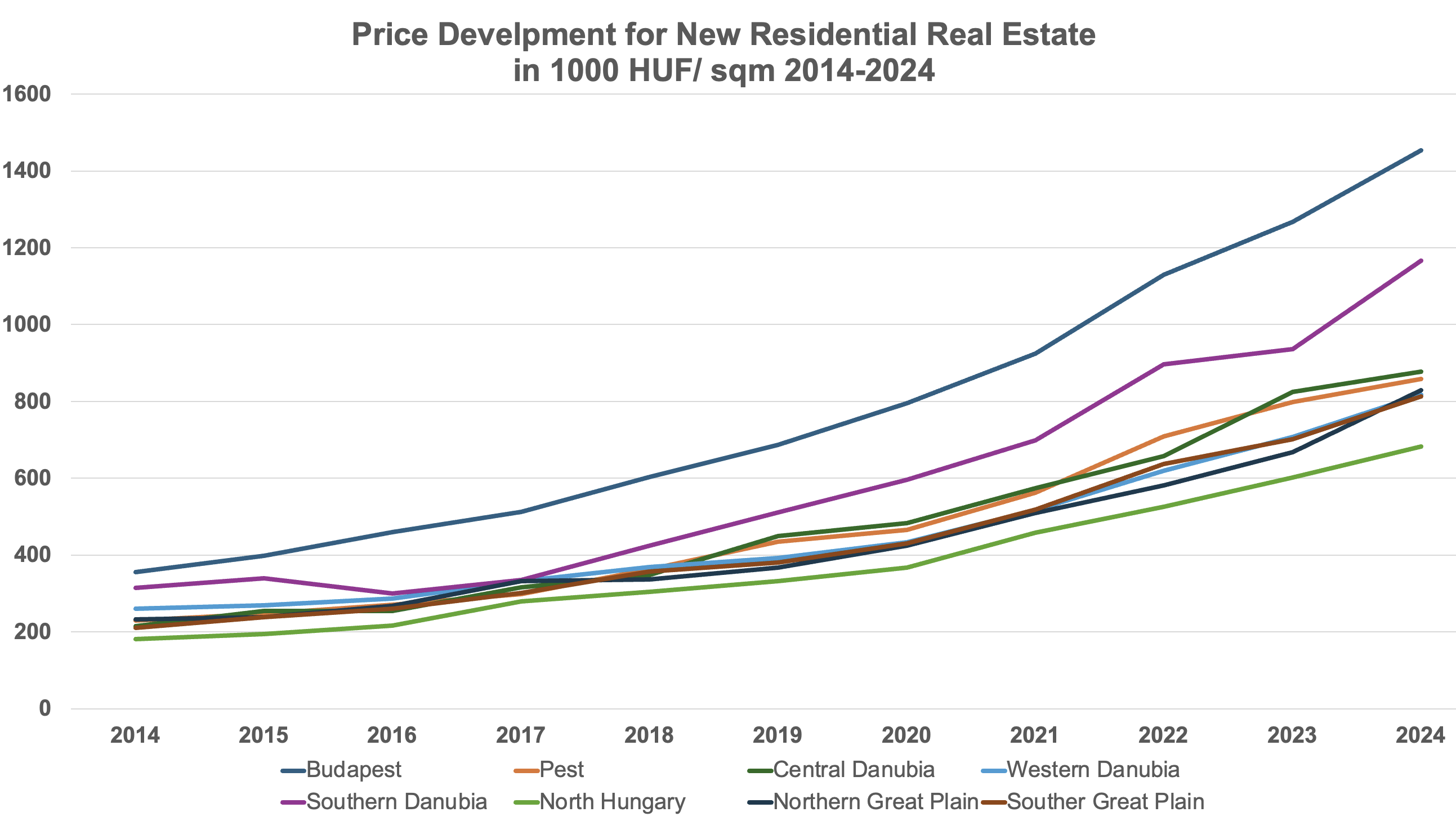

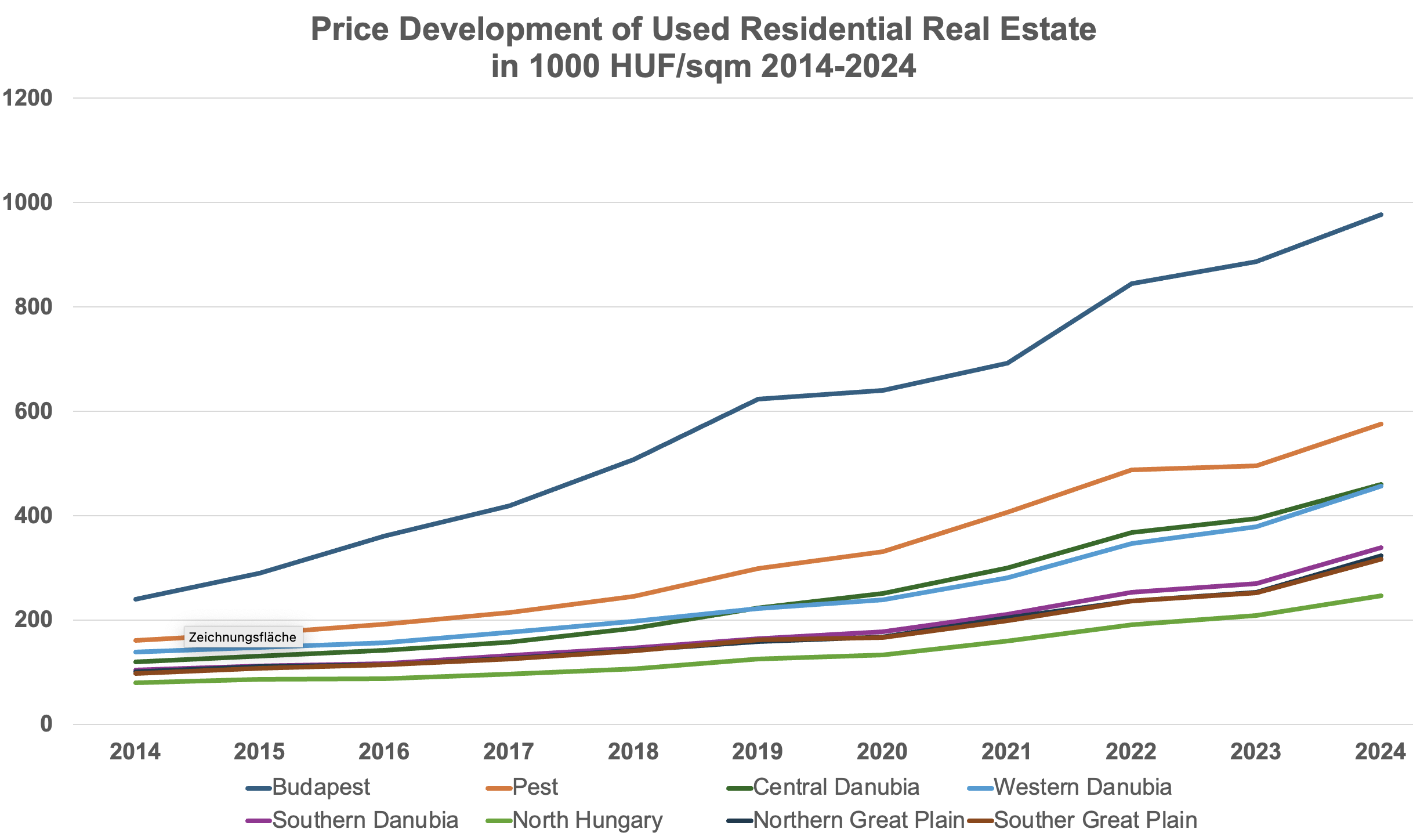

New Build vs. Existing Stock: The Gap Widens

A crucial mistake many buyers make is generalizing.

The market is split:

- New builds: Here, construction costs and energy standards dictate the price. In places like Siófok or Balatonfüred, square‑meter prices of 1.5 to 2.5 million forints (approx. 3,700 – 6,200 EUR) for new developments are no longer unusual.

- Existing properties: Here, the variance is enormous. An unrenovated house from the 1980s is often traded with discounts of 40%, as renovation costs (labor/material) have risen massively in Hungary.

Expert Assessment:

The days when you could renovate “bargains” at Lake Balaton are over. The market now prices the condition of a property brutally honestly. Smart money flows into energy‑efficient existing buildings or new builds.

Sellers who set emotional or speculative prices for unrenovated older properties—based on reports of constantly rising prices—often sit on their listings for years. After several years, they can only sell with significant discounts. Until then, they must either invest in maintaining the substance or accept erosion.

Regional Analysis: From Luxury to “Hidden Gem”

To navigate the market, you must understand the micro‑locations. The average price is misleading. The north side of Lake Balaton is considered the “better side” by many.

- The high‑price cluster:

The municipality of Tihany, Balatonfüred, parts of Badacsony, and exclusive locations in the Keszthely region form the peak. According to ingatlan.com data from late 2024, these locations—with square‑meter prices above 2.6 million forints (approx. 6,500 EUR)—even surpassed the most expensive districts of Budapest (District V). - The entry‑level market:

Southwest of the lake, in municipalities like Balatonmagyaród or the hinterland of Fonyód (approx. 10–15 km from the shore), functional houses can still be found for under 500,000 HUF/m². The price discount is purely due to distance from the water and partially unfavorable demographic composition.

Spotlight: Cserszegtomaj – The Strategic Compromise

Cserszegtomaj occupies a special position and is my personal favorite for strategic investors.

- Location: On the north shore, above Keszthely and close to the thermal lake in Hévíz.

- Prices: Good existing properties currently range between 700,000 and 900,000 HUF/m²; new builds approach the 1.1 million mark.

- Why here? You don’t pay the “waterfront premium” of the first row, yet often receive unobstructed panoramic views and year‑round infrastructure from the city of Keszthely. It is the municipality with the highest purchasing‑power density of expats (Germans, Swiss, Austrians).

Inland Comparison: Southern Hungary vs. Northern Hungary

Let’s take a look at Hungary’s more affordable regions. Prices are lower here, but often so is the infrastructure.

Southern Hungary (Baranya/Villány):

- Top: Pécs (approx. 600–800k HUF/m²)

- Low: Villages near the Croatian border (<150k HUF/m²)

- Trend: Stable, but no hype

- Low: Salgótarján is the cheapest county capital in Hungary (often <300k HUF/m²)

- Trend: Stagnant due to weaker economy

BUT: Anyone buying real estate should always consider resale. Life circumstances change. Some of our clients want to sell again after several years due to family reasons (divorce, illness, death, etc.).

Although the Balaton region is more expensive than Hungary’s northern or southern fringe regions, the market moves much more dynamically and the infrastructure is more attractive. A resale in the Balaton region within a reasonable timeframe is far more promising than in northern or southern Hungary, where you must expect either large price discounts or very long waiting periods.

The European Context: Massive Arbitrage

Why do foreigners buy despite rising prices? Because Lake Balaton is drastically undervalued in a European comparison.

| Lake / Region | Avg. Price (EUR/m²) |

Factor (vs. Balaton) |

|---|---|---|

| Lake Zurich (Gold Coast) | 18'000 - 30'000 | 10-15x |

| Lake Geneva | 15'000 - 25'000 | 8-12x |

| Lake Starnberg | 10'000 - 15'000 | 5-7x |

| Lake Constance | 6'000 - 10'000 | 3-5x |

| Lake Garda | 4'000 - 8'000 | 2-4x |

| Lake Balaton | 2'000 - 3'500 | 1x (baseline) |

Analysis: Anyone selling a house at Lake Constance can buy a villa at Lake Balaton and still have capital left for retirement. This “geo‑arbitrage” supports Balaton prices even in times of crisis.

Conclusion: In terms of pricing, Lake Balaton behaves more like an outer district of Vienna or Budapest than like rural Hungary.

Outlook: What’s Coming in 2026/2027?

My forecast for the next 24 months:

- Consolidation in the mid‑range: Poor and unrenovated building stock will stagnate or fall in price.

- Premium run: Top locations with lake views or new builds in places like Cserszegtomaj, Gyenesdiás, Balatonfüred, or Tihany will continue to rise in value (inflation hedge).

- Euro effect: With the volatility of the forint, real estate will increasingly be priced in euros, making the market more transparent for international buyers.

Do You Want to Understand the Market or Use the Market?

The data clearly shows: Lake Balaton is no longer a “cheap holiday destination” but a robust investment location with European catch‑up potential. However, the wheat separates from the chaff much faster today than 20 years ago.

I don’t just observe this market – I move in it daily. If you need access to real market data or an assessment of a specific property in the Balaton region, contact me. Let’s talk facts.

Quellen & Datengrundlage:

If you’re already in property search mode, here are our main property types in Hungary and at Lake Balaton:Buy a house in Hungary

Buy a villa in Hungary

Buy an apartment in Hungary

Buy a house at Lake Balaton

Buy an apartment at Lake Balaton

Buy a plot of land in Hungary

If you have questions or need assistance, don’t hesitate to contact us.

Author: Dr. Peik Langerwisch

The author, after studying business administration with a degree as a Diplomkaufmann and earning a magna cum laude doctorate in management, worked for twenty years in global consulting firms and banks and now leverages his expertise as a real estate agent for properties in Hungary.

Brief overview of expertise and career

- Where do live most of the Germans in Hungary?

- The Balaton price anomaly: 20 years of the Hungarian real estate market in fact check and why the lake is now beating Europe

- New law: What does the protection of local identity law means for real estate buyers in Hungary

- Emigration to Hungary 2026: What do I need to consider? The ultimate checklist!

- How to successfully sell real estate in Hungary?

- What are the taxation rules for selling real estate in Hungary?

- What are the taxation rules for buying real estate in Hungary?

- Buying a renovated house in Hungary: Guide to a good investment

- What are the additional costs for a house in Hungary?

- How do I exchange Swiss francs or Euros for Hungarian forints the cheapest way and with what risk?

- What are the emergency numbers in Hungary?

- Can you buy a villa in Hungary or even a palace?

- How is the Forint Euro exchange rate developing?

- Where to emigrate in Hungary?

- What are 7 reasons to emigrate to Hungary?

- What speaks for a house purchase at Lake Balaton?

- How are real estate prices developing in Hungary compared to German-speaking countries in Europe

- How is the living situation in Hungary compared to German speaking countries in Europe?

- Do I need a residence card (Lakcímkártya) and how do I apply for a residence card?

- Is Hungary a hunting paradise?

- Buying property in Hungary - Which four questions should I address?