How is the Forint Euro exchange rate developing?

If you want to buy a

house in Hungary or want to migrate to Hungary, you inevitably ask yourself the question, at what rate will euros be exchanged for forints and what is the trend. Even those who have already successfully emigrated to Hungary and own

real estate in Hungary think about why the euro moves in one direction or another against the forint and what are the forecasts for the future.

This article presents the main factors influencing the exchange rate. Depending on the degree of simplification, three factors or somewhat more detailed 9 factors can be cited. This is followed by some interpretations of the EUR / HUF money rate development and some thoughts on the EUR / HUF exchange rate forecast.

Simplified, exchange rates between currencies are determined by three main factors:

- economic situation

- monetary policy

- supply and demand

The economic situation of two countries / currency areas

When one country's economy grows faster than the other, demand for its currency usually increases as more investment and trade are attracted. This leads to an appreciation of one currency against the other. Conversely, a weaker economy leads to less demand and a depreciation of the currency.

The monetary policy of the respective central banks

When comparing central banks of two currency areas, they influence the exchange rate through their monetary policy decisions, such as setting the policy rate, conducting bond purchases or providing liquidity. These actions have an impact on inflation, economic growth, and market confidence in both currencies. Expansionary monetary policy, which aims to stimulate the economy, typically results in lower inflation and interest rates, which reduces the attractiveness of the currency and leads to depreciation. Tight monetary policy aimed at fighting inflation usually leads to higher inflation and a higher interest rate level, which increases the currency's attractiveness and leads to appreciation.

Supply and demand in the foreign exchange market

The foreign exchange market is where different currencies are traded. The supply and demand for a particular currency depends on various factors, such as the trade balance, capital flows, market participants' expectations and political events. When the supply of a currency is higher than the demand, its price falls and it depreciates. When the demand for a currency is higher than the supply, its price rises and it appreciates.

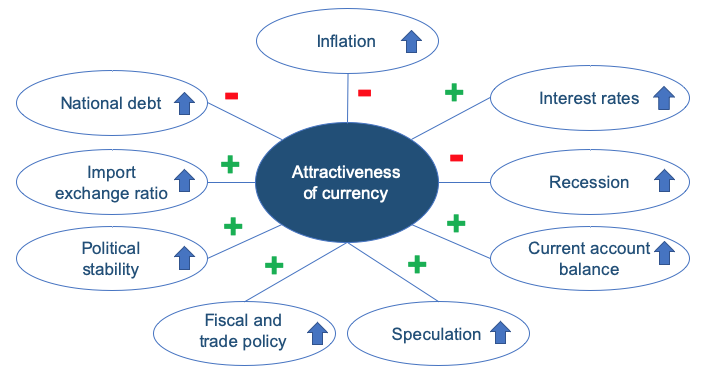

If one goes into a bit more detail, 9 factors influencing the attractiveness of a currency can be found:

Inflation

Lower inflation of one currency compared to another is more attractive. That is, if inflation rises, the value of the currency falls. At the same time, it usually leads to rising interest rates.

Interest rates

If the interest rates of a currency rise, the currency becomes more attractive to lenders due to higher yields. This attracts foreign capital, which causes the currency to appreciate.

Recession

As a rule, interest rates fall in countries with rising recessions in order to support the domestic economy. However, this also makes the country less attractive to foreign capital, which causes the currency to depreciate. The exchange rate falls.

Current account balance

The current account records all expenditures and receipts of an economy from cross-border trade flows (goods and services) as well as income flows (earned income, property income, debt). The current account balance determines whether an economy produces more than it consumes or vice versa. A surplus in the current account balance means that a country's economy exports more than it imports, which leads to an appreciation of its own currency. A current account deficit means that an economy imports more than it exports and incurs foreign debt.

Speculation

If the market expects the value of the country's currency to increase, investors buy more of that currency to profit from rising rates of the currency. This further increases the demand for the currency and appreciates its value.

Fiscal and trade policy

The more sound a country's financial and trade policies are, the more confidence investors have in the country because the risks of abrupt changes are lower. This increases the currency's attractiveness.

Political stability

Markets hate instability and turbulence. The more stable an overall political situation is in one currency zone compared to another, the more predictable investments are, which attracts foreign capital. This increases the value of the currency.

Import exchange ratio

This is a ratio from economics that shows the ratio of export prices to import prices in a country. If export prices rise more than import prices, demand for the national currency increases, which increases the value of the currency.

Government Debt

If the market expects a further increase in government debt, the risk for capital providers also increases. Existing government bonds are sold on the market. As a result, the currency loses value.

As can be easily seen, the influencing factors are complex interrelationships that often do not allow linear causality to be precisely demonstrated, since several factors act simultaneously. However, every now and then there are events that have a stronger effect and can explain the development in retrospect.

What does that mean for the exchange rate development of EUR/ HUF?

For more than 15 years, the euro has been on an uptrend against the forint, with temporary fluctuations and a major outlier in 2022.

EUR vs. HUF Exchange Rate History 1999-2025

Source: ECB, own illustration (2025)

In tabular form, the average EUR/HUF exchange rates over the last 10 years are as follows:

| 2013 |

296.87 |

| 2014 |

308.71 |

| 2015 |

310.00 |

| 2016 |

311.44 |

| 2017 |

309.19 |

| 2018 |

318.89 |

| 2019 |

325.30 |

| 2020 |

351.25 |

| 2021 |

358.52 |

| 2022 |

391.29 |

| 2023 |

381.85 |

| 2024 |

395.30 |

Quelle: ECB

Three detailed examples are discussed below to illustrate the complexity of the influencing factors.

Example 2016

Source: ECB

Source: ECB

An example of a

supply/demand fluctuation would be the Brexit in 2016, which led to increased demand for euros as many investors shifted their assets from sterling into euros to protect themselves from the uncertainties of the UK leaving the European Union. This temporarily boosted the euro against the Hungarian forint, as can be seen in the decline of the EUR/HUF from HUF 314.03 on June 23, 2016 to HUF 308.03 on June 24, 2016.

However, there were other influences in 2016 that had both negative and positive effects for the euro.

Negative influences:

- The economic situation over the course of 2016 was better in Hungary. According to Eurostat statistics, gross domestic product (GDP) in the Eurozone increased by 1.9 percent in 2016. Hungary's GDP grew by 2.2% in 2016. This has increased the attractiveness of the Forint as an investment currency.

- The monetary policies of the Hungarian Central Bank and the European Central Bank (ECB), which have diverged. In 2016, the Hungarian Central Bank lowered the key interest rate from 1.35 percent to 0.9 percent to stimulate the economy. The ECB, on the other hand, cut the key interest rate from 0.05 percent to 0 percent to fight deflation and stabilize the economy. The ECB also expanded its bond-buying program and introduced negative deposit rates. These measures helped make the euro less attractive to foreign investors seeking higher yields.

- Political uncertainty in Europe triggered by Brexit and other events. On June 23, 2016, the British voted to leave the EU in a referendum, causing a temporary shock to markets and a short-term weakening of the euro. Other political events, such as the refugee crisis, terrorist attacks, and elections in various countries, also contributed to increased volatility and risk aversion, which weighed on the euro.

Positive influences:

- The economy in the Eurozone was more stable over the course of 2016 compared to Hungary. According to Eurostat statistics, gross domestic product (GDP) in the eurozone increased by 1.9 percent in 2016, which is a slight deterioration from 2015's 2.0 percent growth. Hungary's GDP grew by 2.2% in 2016, but by 3.7% in 2015, a sharper slowdown in growth. This has increased the attractiveness of the euro as an investment currency and contributed to the appreciation against the forint.

- The European Central Bank's (ECB) monetary policy measures have helped to improve financing conditions for the real economy in the eurozone and support inflation expectations. In 2016, the ECB expanded its bond-buying program and introduced negative deposit rates to combat deflation and stabilize the economy. These measures have meant that financing conditions for companies and households have been more favorable than they would have been in the absence of these measures. This in turn has had a positive impact on economic growth and inflation in the eurozone, making the euro more attractive.

- The political stability in the eurozone, despite the Brexit, the refugee crisis or terrorist attacks, have led to member states working more closely together to find common solutions and deepen integration. This has boosted confidence in the future of the eurozone and supported the euro.

As a result, the EUR / HUF exchange rate was stable on an annual basis in 2016 with close to 0% change due to the many mutually offsetting factors.

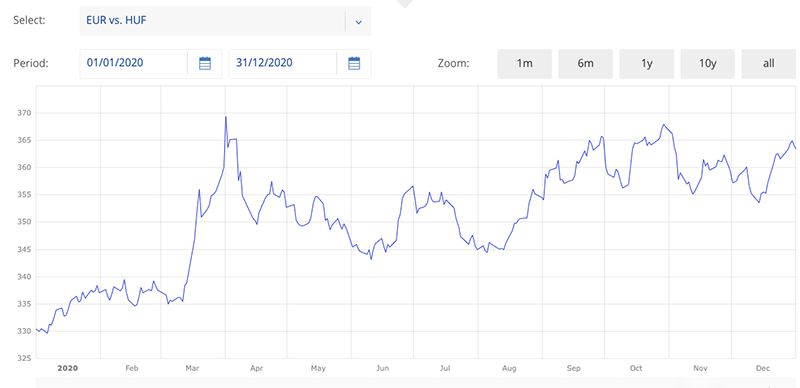

Example 2020

Source: ECB

The existing structure comparing the economic situation of the Eurozone and Hungary has changed due to the COVID-19 pandemic in 2020.

Thus, Hungary's economy was hit harder than the Eurozone's, resulting in a year-on-year decline in gross domestic product (GDP) growth of 10.7 percentage points, while GDP growth in the Eurozone 'only' declined by 8.1%.

These changes in the economic situation of the two currency areas had a negative impact on the forint against the euro. This devalued the Hungarian Forint against the Euro, as can be seen in the increase of the EUR/HUF from 330.53 HUF on January 1, 2020 to 356.92 HUF on March 18, 2020.

Both the Eurozone and Hungary adopted monetary policy measures in the same year to stimulate the economy.

For example, the ECB measures in 2020 included lowering the deposit rate to -0.5%, which made the euro rather less attractive.

At the same time, there was an increase in the Pandemic Emergency Purchase Program (PEPP) to €1.85 trillion and an extension of the Targeted Longer-Term Refinancing Operations (TLTRO) III.

The increase in the PEPP and the extension of TLTRO III in 2020 had a mixed effect on the euro exchange rate. On the one hand, these measures have improved financing conditions for the real economy in the euro area and supported inflation expectations, which has contributed to an appreciation of the euro. On the other hand, these measures have also eased monetary policy in the eurozone and reduced the interest rate differential between the euro and other currencies, which has led to a depreciation of the euro.

According to an analysis by the European Central Bank (ECB), the monetary policy measures taken in 2020, including the PEPP and TLTRO III, have contributed to an improvement in financing conditions for the real economy in the eurozone. These measures have meant that financing conditions for companies and households have been more favorable than they would have been in the absence of these measures. This in turn has had a positive impact on economic growth and inflation in the euro area, making the euro more attractive.

However, monetary policy measures have also led to an easing of monetary policy in the eurozone, which has devalued the euro relative to other currencies. For example, in April 2020, the ECB lowered the interest rate on the TLTRO III from -0.5% to -1% , which means that banks that increase their lending can benefit from a negative interest rate. This has contributed to the ECB's key interest rate remaining at 0%, while during the same period in 2020, the National Bank of Hungary (MNB) reduced the key interest rate from 0.9% to 0.6% in several steps to stimulate the economy, making the forint less attractive against the euro.

The net effect of these factors on the euro exchange rate depends on the relative strength of these factors, which may depend on various market conditions. For example, the effect of improving financing conditions for the real economy may be stronger if the economic recovery in the euro area is faster than in other regions or if inflation expectations in the euro area are rising. Conversely, the effect of easing monetary policy may be stronger if the economic recovery in the euro area is slower than in other regions or if inflation expectations in the euro area are falling.

One way to measure the net effect is to look at the actual exchange rate trend of the euro in 2020. The euro appreciated by 9.8% over the course of 2020. This suggests that the effect of improving financing conditions for the real economy was stronger than the effect of monetary policy easing. However, this increase may have been influenced by other factors, such as the course of the COVID-19 pandemic, geopolitical tensions, or trade relations.

One can see from the 2020 example alone how very different factors can influence the exchange rate to varying degrees. It is almost impossible to bring such complex factors into calculable cause-and-effect relationships.

Example 2022

Let's look at more current developments in 2022.

Source: ECB

The exchange rate between the euro and the Hungarian forint rose sharply in 2022 and then fell again. This is due to various factors that have influenced both the demand and supply of the two currencies. Some of these factors are:

- The economic situation of both countries: in 2022, the Eurozone economy recovered faster than Hungary's after being hit hard by the COVID-19 pandemic in 2020. According to Eurostat data, the eurozone's gross domestic product (GDP) grew by 3.3% in 2022, while Hungary's GDP grew by 4.6%. This would ceteris paribus lead to higher demand for the Forint as more investment and trade would be attracted.

- Central bank monetary policy: inflation has been higher in Hungary than in the Eurozone. According to Eurostat statistics, the inflation rate in Hungary in 2022 was 15.3 percent, while in the Eurozone it was 8.4 percent. This has reduced the purchasing power of the forint and contributed to its depreciation against the euro.

The European Central Bank (ECB) and the National Bank of Hungary (MNB) pursued different monetary policy strategies in 2022 to achieve their respective goals. The ECB has continued its expansionary monetary policy to keep inflation near its 2% target and support the economy. It has kept the policy rate at 0%, extended the Pandemic Emergency Purchase Program (PEPP) until March 2023, and extended the Targeted Longer-Term Refinancing Operations (TLTRO) III until June 2023. The MNB, on the other hand, has continued its restrictive monetary policy to combat high inflation. It has raised the policy rate from 2.9% in January 2022 to 7.75% in July and even 13% in December 2022. After initially appreciating the euro until mid-year, the renewed rate hike made the Hungarian forint more attractive again.

- The supply and demand on the foreign exchange market: In 2022, the supply and demand for the euro and the Hungarian forint has changed several times, which has led to fluctuations in the exchange rate. For example, the Brexit in January 2022 has led to increased demand for the euro as the United Kingdom has finally left the European Union. This has caused the euro to appreciate against the Hungarian forint. Conversely, the fourth wave of COVID-19 measures in October 2022 has led to reduced demand for the euro as several eurozone countries have imposed renewed lockdowns. Last but not least, the drastic increase in key interest rates has led to increased demand for the forint. This has caused the euro to depreciate again against the Hungarian forint.

- The political situation was more stable in the eurozone than in Hungary. The eurozone has benefited from greater political integration and solidarity in 2022, which has been strengthened by the EU reconstruction fund and the Brexit deal. Hungary, on the other hand, has experienced several political tensions, such as conflicts with the EU Commission and the freezing of EU funds for Hungary. These situations have undermined confidence in the Hungarian economy and contributed to a weakening of the forint.

Obviously, the economic development was not so strong that it outweightet the other factors. These factors have led to an overall increase in the exchange rate between the euro and the forint in 2022 from 367.71 HUF/EUR on January 4, with an intermediate high of over 430 HUF/EUR in October 2022, to 400.87 HUF/EUR on December 30. This represents an 8.58 percent appreciation of the euro against the forint in 2022.

Forecast

The current forecast for the exchange rate between the euro and the Hungarian forint is not clear, as there are many uncertainties and fluctuations that can influence the exchange rate.

On January 28, 2025, the EUR reached a new high against the HUF of 416.25, even though we were still some way off the all-time high of 430.

Overall, the EUR/HUF exchange rate is currently continuing to follow a medium-term upward trend. Although the Hungarian central bank's key interest rates, which are high by European standards, are currently strengthening the value of the forint, this does not change the overall trend.

The Hungarian economy's dependence on the German economy, which is in crisis, is likely to have a significant impact on economic weakening. Due to the poor order situation, many assembly and supplier companies made major redundancies in Hungary at the end of 2024 / beginning of 2025.

However, as shown, the forecast for the exchange rate depends on many factors that determine both the demand and the supply of the two currencies.

Some of these factors include the economic situation of both countries, monetary policies of central banks, trade balance, capital flows, expectations of market participants, and political events. Several of these factors may change due to unpredictable external shocks. It is therefore difficult to make an accurate forecast.

One way to make a forecast is to look at different scenarios based on various assumptions about these factors.

For example, one could assume that the eurozone economy grows faster than Hungary's, that the ECB continues its expansionary monetary policy and that there are no major political crises. In this case, one could expect the euro to appreciate against the Hungarian forint.

One might also expect that once inflation in Hungary is somewhat contained, the very high key interest rate will be lowered again, which will cause the forint to depreciate against the euro again.

Conversely, one could assume that Hungary's economy grows faster than that of the euro zone, that the MNB continues its restrictive monetary policy, and that there are major political crises in the EU. In this case, one might expect the euro to depreciate against the Hungarian forint.

And this is where the personal question of faith and assessment begins. Depending on who thinks which scenario is more likely, bet on the euro or the forint. There is no reliable prediction.

Author: Dr. Peik Langerwisch

After studying business administration with a degree in business administration and a magna cum laude doctorate in management theory, the author worked in global management consultancies and banks for twenty years and has now used his expertise as a real estate agent for real estate in Hungary for several years.

Career and Expertise

Sources:

boerse.de

bpb.de

Eurostat

exchange-rates.org

EZB

finanzen.net

investing.com

statista.com

Wikipedia

Wirtschaftslexikon Gabler